National Bank of Fujairah’s head of IT, Dr. Joseph George, relates effective digital banking strategy to the effects of the human body and brain.

The human brain learns and stores information by the minute, which translates to people becoming brighter by the day. As a result, the best conventional banks will need to use technology to ‘go digital’, giving customers real-time convenience. If they fail to follow this model, they face the imminent threat of being left behind by younger, better banks which, through their rational approach to customer convenience and technology focus, will supersede conventional banks in the near future.

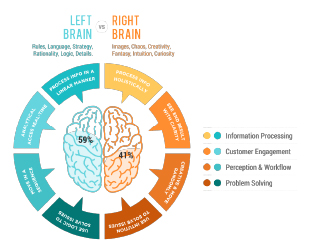

The concept of right-brain and left-brain thinking was documented in the late 1960s by the American psychobiologist Roger W Sperry. He discovered that the human brain has two very different ways of thinking, and won the Nobel Prize in 1981 for his work. The right side is visual-based, and processes information in an intuitive and simultaneous way, looking first at the whole picture and then drilling down into details. The left side of the brain is verbal, and processes information in an analytical and sequential way, looking first at the pieces, then putting them together to get the whole picture.

Although, the right side of the brain – non-verbal thinking – is often regarded as more ‘creative’, there is no right or wrong here; it is merely two different ways of thinking. One is not better than the other, just as being right-handed is not ‘superior’ to being left-handed.

Currently, banking customer behaviour is driven by the right side of the human brain. Just as the right side focuses on visual and holistic aspects, customer experiences are dictated by their experience through front end digital channels.

Digital banks, however, will need to rapidly focus on back end processes to mimic the left side of the human brain, processing information in an analytical and sequential way, looking first at the pieces then putting them together to get the whole picture. This ensures that in any given scenario processes aren’t thwarted, which can lead to an inconvenient customer experience and journey.

It is important to be aware that your customers are learning more every second, and they will always value convenience, which explains why their dependence on conventional banking is diminishing by the day. By understanding customers’ natural preferences, banks can pay more attention to satisfying the brain’s naturally less dominant right side.

To fully understand these diverse changes in customer behaviour, real-time analytics remains the command centre for the digital banking nervous system. Analytics receive input from different channels and sends output to the front end with a reflex reaction. If you are building a digital bank and it does not encompass a reflex action, the end results are destined to fail, as your processes are less dependent on learning, and will tend not to be responding back to the customer’s need.

The human brain’s learning pattern is similar to the way that children grow. They learn constantly, and their reflex action gets adapted to the situation to succeed in the challenges that are put in front of them. However, children who tend to be less adaptive to their reflex will lean toward being less able. Likewise, if your bank is not adaptive to reflex actions based on real-time analytics, it will eventually only be partially-abled.

Anatomy of IQ in digital banking

Like all vertebrate brains, the human brain develops from three sections known as the forebrain, midbrain and hindbrain. Likewise, conventional banks have a front office, middle office and back office. As the progression to becoming digital gathers momentum, a conventional bank moving towards a digital footprint should transform the front office into digital channels using the concept of reflex action.

Like all vertebrate brains, the human brain develops from three sections known as the forebrain, midbrain and hindbrain. Likewise, conventional banks have a front office, middle office and back office. As the progression to becoming digital gathers momentum, a conventional bank moving towards a digital footprint should transform the front office into digital channels using the concept of reflex action.

However, to build the best customer experience and journey, it has to be dynamically linked with the middle and back offices. Optimising and automating middle and back office processes becomes hugely important. A streamlined process is the backbone of your digital bank, and state-of-the-art core banking supported with business intelligence will be its heart.

The brainstem (analytics) connects to the backbone (straight through process), and the primary functions of the brainstem include relaying information between the brain and the body. This, in a digital banking perspective, can be equated to front end channels, and middle and back offices: supplying critical information to the GUI (graphical User Interface) to take care of the aesthetic and emotional needs of the customer, and performing critical functions in controlling the activities of a customer with clear and distinct engagement models.

On the other hand, if real-time analytics flag information stating that the customer is finding it difficult to conduct the transaction or any particular process, the use of intelligent BOTS support should be auto-enabled to help complete the transaction or process.

Leveraging analytics to study customer behaviour can significantly improve top line impact and the ability to achieve a faster time-to-market of marketing initiatives.

With the increasing trend within banks to digitise more and more of their services, it remains essential to accept that customers are not bits and bytes, but human beings, with minds of their own. An approach to digitisation devoid of this acceptance and the human factor is lost. Building a bank’s future on the idea that digital banking will solve everything sets you in the wrong direction. Instead, the obvious approach should be to ask how your bank can be relevant to the everyday life of your customers.