Communications chipmaker Broadcom is planning to unveil a bid for smartphone chip supplier Qualcomm by Monday, three sources familiar with the matter told Reuters. This would create a roughly $200-billion company through the biggest technology acquisition ever.

A tie-up would combine two of the largest makers of wireless communications chips for mobile phones and raises the stakes for Intel, which has been diversifying into smartphone technology from its stronghold in computers.

The value of Broadcom’s bid has not been decided, though an offer in the range of around $70 to $80 per share is being contemplated, one of the sources said. At $70 a share, an offer would value Qualcomm at $103 billion.

“It’s a smart move that would make Broadcom into a tech juggernaut,” said GBH Insights analyst Daniel Ives.

Qualcomm declined to comment, while Broadcom did not immediately respond to a request from Reuters for comment.

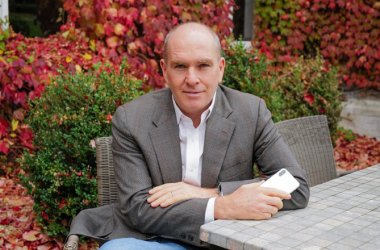

Reuters says the bid comes as Broadcom plans to move its headquarters to the United States from Singapore. U.S. President Donald Trump commented on the move on Thursday at a White House event where Chief Executive Hock Tan cited Republican tax efforts. It is currently incorporated in Singapore and co-headquartered there and in San Jose, California.

Broadcom’s acquisition would be the most ambitious move by Tan, who has turned a small, scrappy chipmaker into a $100-billion company with a string of deals, since he took the helm a decade ago.

The proposal comes as Qualcomm is trying to close its pending $38-billion acquisition of NXP Semiconductors NV. NXP is one of the largest makers of chips for vehicles and expanding into self-driving technology, and Broadcom also is open to acquiring NXP, according to one of the sources.