A new research report released today by International Data Corporation (IDC) shows that the Middle East and Africa (MEA) enterprise hardware market (comprising servers and external storage) remained flat in 2015 when compared to the annual revenues seen in the previous year.

According to the research firm’s latest Quarterly Server and Disk Storage Systems Tracker, the enterprise hardware revenue in MEA totaled $2.31 billion in 2015 and IDC described the year as transitionary in nature with organisations gradually moving towards convergence and data centre optimisation.

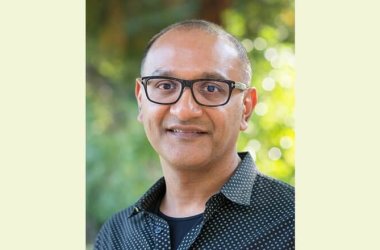

“The region’s enterprise hardware landscape has transformed significantly in recent times, with organisation’s across MEA now increasingly focusing on converged systems and cloud solutions,” says Swapna Subramani, Research Manager, Enterprise Infrastructure, IDC Middle East, Africa, and Turkey. “Given the challenging economic and political conditions now characterising much of the region, convergence and optimisation are becoming key.”

In line with this trend, the region is seeing increasing adoption of new technologies like converged systems, while procurement of infrastructure for cloud environments is also on the rise. The converged systems market, which includes hyper-converged appliances, grew by six percent year on year in 2015, and IDC expects this growth rate to reach 12 percent in 2016. “New datacenter investments will leverage converged/hyper-converged infrastructures to support both public and private cloud deployments,” says Subramani.

The MEA external storage market declined three percent year on year in 2015. ”The region’s storage dynamics are swiftly moving in two different directions,” says Subramani. “First is the movement into low-cost, scalable storage, while second is the growth of internal storage, which includes the value of storage enclosed within application servers containing three or more mass storage devices.” IDC expects the high-end storage market to witness considerable uptake in the region during 2016, primarily bolstered by projects within the government, telecommunications, and oil and gas sectors. “The availability of alternative modes of storage such as flash, internal storage, converged systems, and cloud storage are the key driving factors for the ongoing shift we are seeing within the MEA storage market,” says Subramani.

Year on year, the MEA x86 server market witnessed two percent growth in value but a four percent decline in volume in 2015. “IDC witnessed an increased focus on high-end servers in 2015 as a result of investments increasingly being directed towards data centre and cloud infrastructure projects,” says Victoria Mendes, Senior Research Analyst, Enterprise Infrastructure, IDC Middle East, Africa, and Turkey. “This trend has resulted in an increase in the market’s value despite the decline in server shipments.”

The UAE enterprise hardware market grew three percent in value year on year in 2015. “The UAE was not hugely affected by the oil crisis in 2015 with a number of projects underway in the telecommunications, government, and banking sectors,” says Mendes. “However, in line with the prevailing economic sentiment of the wider region, 2016 is expected to see a minor decline in the enterprise space as a number of key projects are postponed and budgets are cut.”

Saudi Arabia is expected to be heavily impacted by the oil crisis and the ongoing conflict in Yemen. The Kingdom’s enterprise hardware market suffered a 12 percent decline in value year on year in 2015 and IDC forecasts a further 17 percent decline for 2016. However, the longer-term picture is far less gloomy, with IDC expecting the Saudi enterprise hardware market to stabilise and exhibit a five-year compound annual growth rate (CAGR) of five percent through to 2020.