Cisco Systems stunned Wall Street on Wednesday with a gloomy financial forecast it blamed on falling demand in developing countries and transitions in some of its product lines.

Cisco Systems stunned Wall Street on Wednesday with a gloomy financial forecast it blamed on falling demand in developing countries and transitions in some of its product lines.

The networking giant expects its revenue this quarter to fall between 8 percent and 10 percent from a year earlier, executives said on a conference call to discuss financial results from its fiscal first quarter. The company also gave profit forecasts for the quarter and the full fiscal year that were below financial analysts’ expectations.

Cisco gave the forecasts after reporting that it missed its own revenue forecast for the quarter ended Oct. 26. The company posted revenue of US$12.1 billion, which fell below the consensus estimate of $12.36 billion from analysts polled by Thomson Financial. Profit fell from a year earlier.

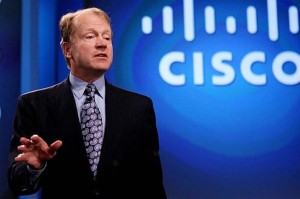

Product orders fell across the developing world in the latter part of the quarter, Chairman and CEO John Chambers said on the conference call.

“Every one of our top 10 emerging countries missed their forecast and was off by a fair amount,” Chambers said. “The last couple of weeks, they kept dropping and dropping.”

Orders fell 30 percent from a year earlier in Russia, 25 percent in Brazil and 18 percent in Mexico, India and China, Cisco said. The trend followed flat overall orders in the previous quarter and is likely to continue for the next few quarters, Chambers said.

Customers are cautious because of economic uncertainty, the executives said. But asked about concerns over U.S. surveillance following revelations about the National Security Agency, they said those worries also have had some effect for the California company.

“I do not think it is the major factor across all of emerging markets. I do think it is a factor, however, in China,” Chambers said.

“It’s not having a material impact. But it’s certainly causing people to stop and then rethink decisions, and that is, I think, reflected in our results,” said Rob Lloyd, president of development and sales.

Some of the current woes are specific to Cisco. The company is in the process of rolling out new generations of carrier network gear, which affected service-provider orders, executives said. It’s also in a transition from selling set-top boxes for carriers’ broadband customers to using cloud-based architecture that ultimately will be more profitable, they said. At the same time, Cisco is taking charges for an ongoing restructuring that includes eliminating 4,000 jobs.

There was good news in some areas. Product orders in the U.S. enterprise and commercial sector rose in the high single digits, the company said. The company has high hopes for its Application Centric Infrastructure platform, unveiled last week in conjunction with its buyout of Insieme Networks. Chambers said the company is still committed to developing markets and stands by its long-term growth forecast of between 5 percent and 7 percent annual revenue growth.

But financial analysts on the call expressed surprise at the grim forecast, and Cisco’s stock was down about 10 percent in after-hours trading on Thursday.

For the first quarter, Cisco reported net income of $2 billion, down 4.6 percent from $2.1 billion a year earlier, measured according to generally accepted accounting principles. On a per-share basis, that came out to $0.37, down from $0.39. Not counting certain one-time items, Cisco earned $0.53 per share, exceeding analysts’ forecast of $0.51 per share.