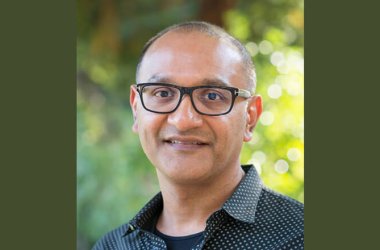

CNME Editor Mark Forker sat down for an exclusive interview with Georgio Khachan, Vice-President – Banking and Finance Solutions at Raqmiyat, where he reiterated that his vision for the company was to become a strategic partner and ‘digital enabler’ for financial institutions looking to embrace digital transformation across the GCC.

Georgio, you’ve recently taken the helm at Raqmiyat Banking & Finance Solutions—how would you describe your vision for the company’s role in shaping the future of digital banking and payments?

My vision is for Raqmiyat to be a strategic partner and digital enabler for banks and financial institutions across the GCC.

We already support more than 50 banks with critical systems, and the next step is to take this strong base forward with innovation that delivers further value and keeps banks competitive in a fast -changing market.

I want us to help banks cut costs with automation and AI, enhance customer journeys, and create new revenue streams through innovative digital banking solutions.

We’ll achieve this by strengthening our own product portfolio while also working closely with leading global technology providers, so clients benefit from both local expertise and the latest innovations.

Raqmiyat has already made a strong mark in enabling digital transformation in the banking sector. How do you plan to build on that legacy and expand the company’s impact under your leadership?

Raqmiyat has built a strong legacy in the UAE by delivering banking systems like Instant Payments, Cheque Clearing, Wage Protection, Direct Debit, and Fund Transfer. My role now is to take that foundation and translate it into the next stage of growth.

That means moving from being a trusted systems provider to becoming a strategic partner for banks in their digital journey. We’re doing this in three ways:

- Introducing new platforms like Open Finance and Payment Orchestration, which enable banks to open ecosystems, streamline payment flows, and create new revenue opportunities.

- Scaling partnerships with global and regional providers, so clients get the latest innovations while relying on our local expertise.

- Expanding into the wider GCC, where demand for advanced payment and digital banking solutions is growing rapidly.

We’ll extend Raqmiyat’s impact beyond its strong UAE base and position the company as a regional leader in digital banking innovation.

The financial services sector is evolving rapidly. What do you see as the most pressing challenges banks, PSPs, and financial institutions face today, and how is Raqmiyat addressing them?

The three biggest challenges are: staying compliant with evolving regulations, meeting customer demand for seamless banking experiences, and managing costs while modernizing legacy infrastructure.

At Raqmiyat, our platforms are compliant by design and aligned with central bank mandates, so banks can move quickly without regulatory risk.

We also provide modular solutions that integrate into existing systems with minimal disruption and take advantage of the latest technologies.

And because cost is always a concern, we design every solution to deliver strong ROI – whether through automation to cut manual work, cloud-native deployments to reduce infrastructure spend, or efficient implementation to speed up results.

How is Raqmiyat leveraging emerging technologies such as AI, blockchain, or real-time payments to enhance digital banking experiences?

We’re embedding AI into real banking use cases through our in-house data transformation vertical.

This covers data management, cloud, business intelligence, and advanced analytics like AI, GenAI, and data science.

This allows us to deliver predictive insights that help banks manage risk and improve efficiency, while also enabling AI models that automate processes and personalize services.

On the payments side, our IP products — like Cheque Clearing and the Instant Payment engine integrated with the UAE Central Bank — use AI to forecast transaction volumes, predict customer churn, and detect anomalies before they cause disruption.

That delivers a smoother customer experience in real time.

We’re also piloting blockchain in cross-border payments, where it can improve transparency, reduce costs, and speed up settlement.

These technologies are helping banks open their ecosystems and deliver new digital experiences that provide real value to customers.

Banks and PSPs are under constant pressure to deliver seamless, secure, and innovative experiences to their customers. How does Raqmiyat help them strike that balance?

Seamlessness, security, and innovation don’t always move in the same direction.

Innovation can bring risk. Security can slow down the journey. Making things seamless can sometimes weaken controls.

At Raqmiyat, we help clients balance by bringing together the right mix of products and expertise.

- We design solutions with compliance and security built in from the start. So, innovation never comes at the cost of regulation.

- We use AI and predictive analytics to keep digital journeys smooth. We improve efficiency and manage risk quietly in the background.

- We work with leading partners in payments, observability, data transformation, customer engagement, loyalty, and others. So, clients can adopt the latest innovations with confidence.

- And we guide them through clear, phased roadmaps.

This way, our clients don’t have to choose between being seamless, secure, or innovative. They can achieve all three in a sustainable, future-ready way.

Trust and security are critical in digital finance. What measures does Raqmiyat take to ensure solutions are not only innovative but also resilient and secure?

For us, security is built into the way we design and deliver solutions. It’s never an afterthought.

Our platforms are built to always be reliable and available. We also put clear governance in place around data, privacy, monitoring, and recovery, so banks can demonstrate trust and compliance to regulators and customers.

We only work with trusted global partners, so every solution we deliver is proven, safe, and future ready.

That way, when clients adopt innovation through us, they know it’s backed by the resilience and trust their customers expect.