Internet of Things payments market will grow at an average of 75 percent per annum over the next five years reaching $410 billion by 2023, according to a recent study by Juniper Research.

The figures are up from an estimated $24.5 billion in 2018.

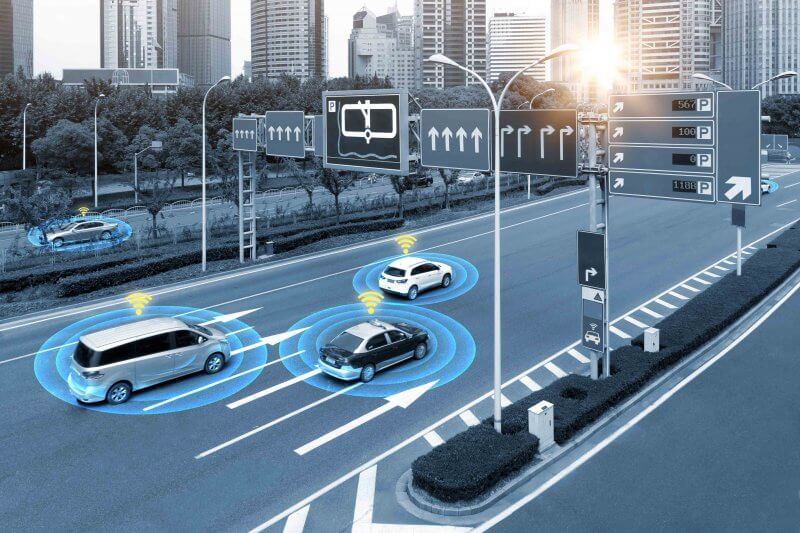

The new research titled, IoT in Finance: Payments, Insurance & Banking Opportunities, Transaction Forecasts 2018-2023, has found that the automotive sector will become the most lucrative IoT platform by 2021. The sector could potentially account for $63 billion in transactions that year, 55 percent of the overall market, compared to just over $50 billion for connected home devices, including smart speakers and TVs. However, car‑based spend will mostly be payments for fuel and tolls, but with little increase in spend overall.

Meanwhile, smart speaker voice-enabled commerce transactions are forecast to reach $51 billion annually by 2023. Goods purchased through these devices will account for just under 12 percent of connected home transactions by volume over the next five years. The majority of purchases will be for digital content, typically made through connected TVs.

“Full financial service products will be slow to come to voice commerce, as the automated processes need to satisfy compliance requirements”, remarked research author James Moar. “However, with voice assistants already supplying advisory and finance updates, there will be much data to draw on once the regulatory requirements are met.”

The research found a significant opportunity for players in the IoT-enabled insurance market which will exceed $334 billion by 2023, primarily through telematics-based motor policies. However, this will reduce premiums; impacting insurers’ gross revenues. Juniper believes that this decline in premiums will be offset by improved overall profitability due to reduced costs per claim; this will become more immediately evident in home insurance, with automated accident prevention through the IoT.