Emirates NBD has launched FaceBanking, a new service that will offer the bank’s customers instant video and live chat with advisors on its revamped Online Banking platform as well on its mobile banking app.

According to the company, FaceBanking is a significant addition to its growing portfolio of digital banking innovations, all designed to create a customer-first banking experience via seamless solutions that match customers’ lifestyles and needs.

Suvo Sarkar, senior executive vice president and group head, Retail Banking and Wealth Management, Emirates NBD, said, “Moving from a transactional to a social experience, our new online platform truly delivers on Emirates NBD’s promise of providing digital banking with a human touch. Be it a query on an account or a loan discussion, customers can chat with a Personal Banking Advisor from anywhere with the click of a button via FaceBanking.”

He added that the dashboard is innovative in its approach to helping customers manage their finances, and providing meaningful insights on their spending habits. “Every new feature added in this portal goes one step ahead in delivering a seamless, user-friendly banking experience and helping our customers fulfil their dreams, and live their life to the fullest.”

The new service empowers customers to instantly connect with a Personal Banking Advisor for queries and transactions by simply clicking a button on Emirates NBD’s enhanced Online Banking platform, thus effectively bringing in human interaction to digital banking, a first for the region’s banking industry. FaceBanking is available 24/7 and offers customers the option of chatting with a bank representative with Priority and Private banking customers also able to initiate a video call.

Emirates NBD highlighted that FaceBanking and the relaunched Online Banking platform are part of its tech-plus-touch ethos which complements its digital innovation initiatives with a human touch to offer customers an intuitive, customised and social banking experience. The initiative forms part of the banking group’s AED 1 Billion commitment towards digitalisation and multichannel transformation of its processes, products and services over the next three years.

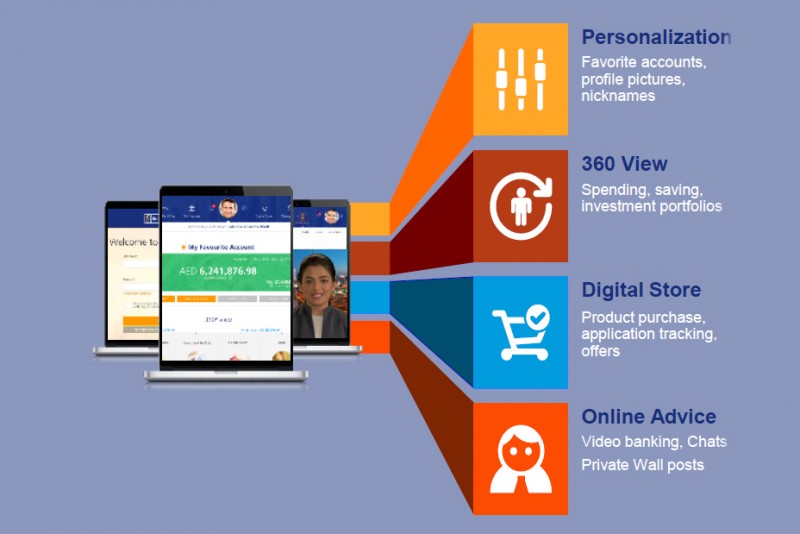

With a newly designed user friendly interface and customer centric approach, the new platform includes a diverse range of features, allowing users to personalise their profiles with images and links to their social media, create nicknames for accounts and cards for simpler and speedier transactions as well as input personal savings goals, said the bank.

Based on individual data, the new website will offer customers smart insights on their money and recommendations tailored to their lifestyles as well as assist in creating realistic savings targets, understand their net worth based on assets and liabilities and provide them with a curated, customised feed of new offers via the Digital Store.