The announcement is the most recent in a series of steps affirming the CBB’s commitment to developing Bahrain into a leader of fintech innovation.

The announcement is the most recent in a series of steps affirming the CBB’s commitment to developing Bahrain into a leader of fintech innovation.

The UAE is working with Saudi Arabia’s central bank to develop a joint digital currency to be used for cross-border transactions between the two nations.

“Smart contracts need to be developed to the point where they are admissible in court and can be used in dispute resolution,” said Khalid Hamad.

Bitcoin made news recently by surpassing the $10,000 price barrier, up from just around $800 in 2016. It is a …

The SelfServ 80 series delivers the omni-channel experience whilst ensuring reliable and secure access to cash for consumers.

In addition to Fintech Hive, DIFC will be introducing two new programmes that focuses on RegTech and InsurTech in 2018.

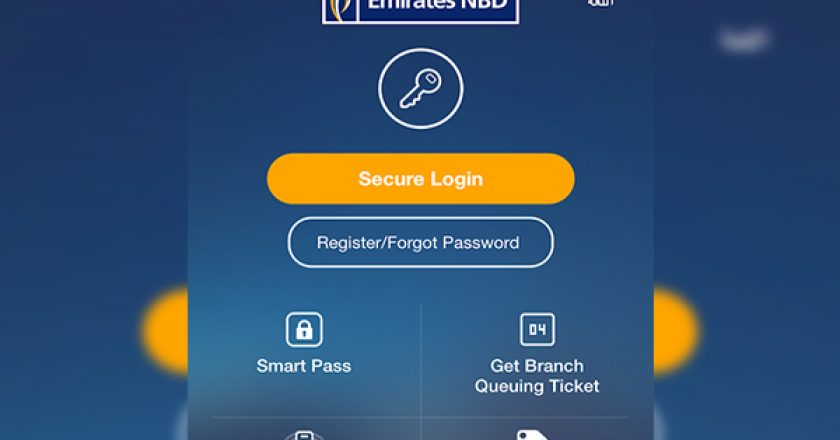

Emirates NBD’s online and mobile channels now enable customers to perform over 100 different transactions – all of which are set to be enhanced through Gemalto’s latest offering

In these days of accelerated digital transformation, a keenly-awaited development in the UAE is a safe and convenient mobile solution for personal financial transactions that can be funded with cash or bank account.

The firms were shortlisted from a pool of 166 applicants and are currently undergoing an intensive five-week selection programme.

GET TAHAWULTECH.COM IN YOUR INBOX